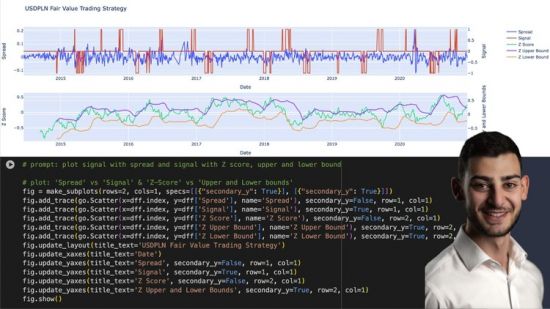

Trader at Elite Hedge Fund: FX Fair Value Trading Strategy

Trader at Elite Hedge Fund: FX Fair Value Trading Strategy

Published 8/2024

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz, 2 Ch

Language: English | Duration: 3h 48m | Size: 1.61 GB

Learn how to trade FX like the best Hedge Funds on the planet!

What you'll learn

How a hedge fund trader trades FX (FOREX)

How a FX Fair Value trading strategy works

How to build a FX Fair Value trading strategy in Python (Beginner)

How to use Python to pull data from Bloomberg and Yahoo Finance

Different ways to clean data in python

How to run OLS regression analysis

The key factors that affect exchange rates (FX)

How to construct Fair value models in Python

How the ADT test works

how to use the ADF test to test for mean reversion tendencies

Constructing spreads between fair value models and fx prices

Generate trade signals in python

Ways in which one can optimise the strategy

Requirements

No programming skills needed beyond watching a few introductory videos.

Basic python skills, and financial market knowledge on FX is advantageous but not a prerequisite

Description

This course will give you exposure to how some of the best hedge funds on the planet trade FX (FOREX). I have spent the vast majority of my career in front office roles at some of the most prestige funds on the planet. My goal is to leverage my experience at Bluecrest Capital and Brevan Howard Asset Management and teach retail traders how institutional traders think about and trade financial markets. There is a clear disparity between the success of retail traders and hedge fund traders, most of this can be attributed to the information asymmetry between the two. Retail traders tend to be very technical analysis driven, whereas, whilst institutional traders incorporate technical analysis it is a small part of their trading process. They focus heavily on mathematical and statistical techniques to identify mis-pricing in markets and aim to take advantage of these asymmetric opportunities.This course will give you exposure to one of the best and most commonly used strategies (in my opinion) for trading FX The course will teach you how the strategy works, the core components of the strategy, how to implement it in python and how to generate trade ideas using the strategy. We will then focus our attention to different ways to backtest the strategy as well as explore additional ways the strategy can be further developed/optimised. By the end of the course, students should be able to construct proprietary Fair Value models for a multitude of currencies and use these models to identify asymmetric opportunities in markets.

Who this course is for

This course is designed for retail traders who want to develop institutional grade trading strategies used by some of the most elite funds.

Those with very little python skills who want to begin analysing data and develop trading strategies in Python.

University and college student who want to pursue a professional career in trading and investin

HOMEPAGE

https://www.udemy.com/course/trader-at-elite-fund-fx-fair-value-trading-strategy/ DOWNLOAD

https://rapidgator.net/file/fa5436933c26fd9142a0f0fa4d6ee0f7/Trader_at_Elite_Hedge_Fund_FX_Fair_Value_Trading_Strategy.part1.rar.html

https://rapidgator.net/file/5a351c27ba0b1de27956429f7fe2ea0e/Trader_at_Elite_Hedge_Fund_FX_Fair_Value_Trading_Strategy.part2.rar.html

https://ddownload.com/za4xt3wtqtbf/Trader_at_Elite_Hedge_Fund_FX_Fair_Value_Trading_Strategy.part1.rar

https://ddownload.com/5snssblkuz3l/Trader_at_Elite_Hedge_Fund_FX_Fair_Value_Trading_Strategy.part2.rar

https://rapidgator.net/file/5a351c27ba0b1de27956429f7fe2ea0e/Trader_at_Elite_Hedge_Fund_FX_Fair_Value_Trading_Strategy.part2.rar.html

https://ddownload.com/za4xt3wtqtbf/Trader_at_Elite_Hedge_Fund_FX_Fair_Value_Trading_Strategy.part1.rar

https://ddownload.com/5snssblkuz3l/Trader_at_Elite_Hedge_Fund_FX_Fair_Value_Trading_Strategy.part2.rar